With classes now starting for many college and universities, students all over the country are leaving their parents’ homes and moving into on- and off-campus housing near their respective campuses.

If you have a student getting ready to attend college, there are a number of important insurance considerations to take into account including property and liability insurance, auto insurance, and health insurance.

Below is a list of recommendations we have put together to ensure both you and your child are properly covered while he or she is away at school.

If you have any specific coverage questions at all, please don’t hesitate to reach out to our office.

If any of the following incidents were to happen, do you know if your homeowners insurance would pay the full claim, part of the claim, or deny it completely?

- Your golf clubs are taken out of your car.

- Your expensive digital camera is dropped and broken.

- Your home-office computer is ripped off.

Unfortunately, with just a standard homeowners insurance policy, the likelihood of your full claim being paid is not great.

While your homeowners insurance policy does provide some coverage for valuable items, it is usually limited in the types of covered claims and payment amounts.

To have full coverage for the incidents above, you would need to purchase a Personal Articles Floater. A personal articles floater provides coverage for possessions with higher monetary values like:

- Cameras (video or still) and related equipment

- China and crystal

- Firearms

- Golfer’s equipment

- Jewelry

- Musical instruments

- Personal computers

- Silverware

- Works of fine art

It will also provide some additional coverage for things like mysterious disappearance and breakage. And the best part is that this type of policy isn’t costly at all.

Why should I consider a Personal Articles Floater?

Benefit 1: A personal articles floater will provide higher limits on your valuables.

Standard insurance policies limit coverage for the items listed above at anywhere from $500 to $1,500 depending upon the item. In many cases, that may be sufficient; however, if the item is rare or valuable, the regular might not be enough.

One of the benefits of a personal article floater is the freedom you have in selecting your limits. Rather than predetermined limits, insurance companies are more willing to provide higher limits (as long as you can provide proof of said value).

Benefit 2: Claim payments are facilitated more proficiently.

Claims for personal articles floater usually paid one of two ways:

- Replacement Cost: Your insurance will pay the necessary amount to repair or replace your item with another one of like kind and quality.

- Agreed Value: The insurance company will use an “Agreed Value” limit for the item. This means that, in the event of a covered claim, your insurance company will pay you the amount listed on the policy.

An agreed value limit is great when you’re insuring items like jewelry, fine art, antiques, and other unique items because it means if you suffer a loss on a covered item, you will not have to negotiate a settlement price with the insurance company.

Benefit 3: A personal articles floater provides expanded coverages.

A standard homeowners policy does not include some vital coverages for rare or valuable items. For example, a personal articles floater can provide coverage for “mysterious disappearance” or “breakage.” So if you were to lose a valuable piece of jewelry or accidentally break some fine china, your policy would pay the associated claim.

Benefit 4: Coverage can be expanded worldwide.

While most homeowners policies will typically only cover items located on the premises listed within the policy, personal articles floaters will provide coverage anywhere in the world.

For example, if you lost your expensive camera while on vacation, your policy would pay for a replacement.

Benefit 5: Most personal articles floaters do not have a deductible.

A standard homeowners insurance policy will usually include a $500 to $1,000 deductible. A personal articles floater is different; many of them actually remove the deductible removing any out-of-pocket expenses as the policy owner.

Some Tips when Adding this Coverage

- Make sure to keep a detailed list of the items listed on the policy, including copies of the appraisals.

- Photograph each piece of your collection and store the photos in a safe place. This will make it easy to list each item on your claim report if your entire collection is stolen or damaged.

- If you have several high-value items, it may be in your best interest to store them in a safe deposit box or install a security system in your home. Doing so will help discount the premiums on your policy as well.

How Much Does the Coverage Cost?

Now the big question, right? How much does a policy of this type of cost?

Personal article floaters are actually much cheaper than you think, given the coverage they provide. The increased cost can be anywhere from $20 to $2,000 annually, depending upon the type of items insured and their associated value.

*The above information is to be used as guidance only and should not be considered definite in any particular case. Every policy is different, and you need to read through your policy and consult with your agent to determine how your coverage will respond. This article cannot analyze every possible loss exposure and exception to the general guidelines above.

A Personal Articles floater is used to insure valuable personal property that often requires more coverage than what is provided by an insured’s homeowner policy due to various exclusions and limitations on homeowner coverage. The personal articles floater can be used to ensure the following categories of personal property:

– Jewelry: Most personal jewelry can be included on a floater; however, jewelry is given more consideration than other personal items. Generally, any item over $1,000 in value would require an appraisal.

– Furs: Fur coats, personal fur items consisting of fur, garments trimmed with fur, and even imitation fur can be included.

– Fine Arts: Fine arts can include private collections of paintings, antique furniture, rare books, glasses, ornament knickknacks, and manuscripts. Fine arts are insured on a valued basis, which means if a loss occurs, payment would be made for the amount of insurance stated in that particular item’s schedule.

– Cameras: Items usually included are motion picture recording equipment, projection machines, films, binoculars, and telescopes.

– Bicycles: Each item must be described on a schedule with an amount of insurance.

– Musical Instruments: Most personal musical instruments, including sound and amplifying equipment, can be listed on a floater. Each item should be listed on a schedule with the requested amount of insurance coverage.

– Silverware / China / Crystal: Item must be listed on a schedule with the insurance amount.

– Stamps / Coin Collections: Valuable stamps and coin collections can be insured either on a scheduled basis or a blanket basis.

– Guns: Each item must be described on a schedule with an amount of insurance.

– Golfers Equipment Most golf equipment, including the insured’s golf clothes.

Although there are no standard floater policies, most floater policies share the following four characteristics:

- The coverage can be tailored to ensure a specific type of property.

- The insured can select the appropriate policy limit for the property.

- Floaters are typically written on an all-risk basis, which means all direct physical losses to the property are covered, except for specially excluded losses.

- Most floaters cover the property anywhere globally; however, fine arts are usually covered only in the United States.

Exclusions: The personal articles form contains two exclusions that apply: the property is not covered for wear and tear, deterioration, or inherent vice. The property is not covered for loss caused by insects or vermin.

Self-driving cars are definitely on the way. In fact, one transport scholar at the University of Minnesota estimates that by 2030 every car on the road will be driverless.

From a safety standpoint, this could be great news as most accidents are caused by human error. If this factor can be minimized by taking control of the moving vehicle away from the driver, accident rates should tumble.

An accident’s risk is unlikely to be completely removed, though, since events are not totally predictable and automated systems can fail. Also, the transition from hands-off driving to hands-on promises to be tricky.

Additionally, driverless cars are still fraught with several safety questions:

- What kind of training will people need to handle these types of vehicles safely?

- How well prepared will drivers be to handle emergencies when the technology returns control to the driver?

- What are the insurance implications of autonomous vehicles?

- Who is ultimately liable in an accident – the manufacturer or the driver?

Many of the questions above will be appropriately answered when the first driverless cars actually hit the road. But in the meantime, we have gathered some research data and insight on how insurance companies are starting to view this new risk.

Insurance Implications

Except that the number of crashes will be greatly reduced, the insurance aspects of this gradual transformation to driverless carts are still unclear. It will also be interesting to see if the accidents that occur lead to a higher percentage of product liability claims, as claimants blame the manufacturer or suppliers for what went wrong rather than their own behavior.

Liability laws will also have to evolve to ensure autonomous vehicle technology advances are not brought to a halt.

Auto Insurance: Some aspects of insurance will be impacted as autonomous cars become the norm. There will still be a need for liability coverage. Still, over time the coverage could change, as suggested by the 2014 RAND study on autonomous vehicles, as manufacturers and suppliers and possibly even municipalities are called upon to take responsibility for what went wrong.

Coverage for physical damage due to a crash and losses not caused by crashes but by wind, floods, fire, and theft (comprehensive coverage) is less likely to change. Still, it may become cheaper if the potentially higher costs to repair or replace damaged vehicles is more than offset by the lower accident frequency rate.

Underwriting: Initially, many of the traditional underwriting criteria, such as the number and kind of accidents an applicant has had, the miles he or she expects to drive, and where the car is garaged, will still apply, but the make, model, and style of car may assume greater importance. The implications of where a car is garaged and driven might be different if there are areas set aside, such as dedicated lanes, for automated driving.

During the transition to wholly autonomous driving, insurers may rely more on telematics devices, known as “black boxes,” that monitor driver activity. According to the National Association of Insurance Commissioners, telematics’ use is forecast to grow to up to 20 percent within the next five years.

Liability: As cars become increasingly automated, the onus might be on the manufacturer to prove it was not responsible for what happened in the event of a crash. The liability issue may evolve so that lawsuit concerns do not drive manufacturers and their suppliers out of business.

Repair Costs: While the number of accidents is expected to drop significantly as more crash avoidance features are incorporated into vehicles, the cost of replacing damaged parts is likely to increase because of the complexity of the components. It is not yet clear whether the reduction in the frequency of crashes will reduce the cost of crashes overall.

Home Insurance Exclusions: 10 Things Home Insurance Won’t Cover

Every homeowner needs to know the ins and outs of their home insurance policy, but sometimes knowing what isn’t covered can be just as important as knowing what is. Here are 10 home insurance exclusions that every homeowner should be aware of.

1. Mold Damage

Most home insurance companies exclude mold damage from their policies. Unlike a fire or tornado, insurers see mold damage as a problem that grows over time, and homeowners are expected to take preventive measures to prevent mold spores from spreading throughout the home. If left unchecked, mold can cause structural damage to the home and serious health issues for residents.

2. Floods, Earthquakes, Landslides

As many homeowners found out in Hurricane Katrina, flood insurance is not covered under a standard home insurance policy. For protection against flood damage, you’ll need to purchase a separate flood insurance policy.

Earthquake and landslide damage are also notable home insurance exclusions. You will need separate coverage for damage caused by these perils.

3. Aggressive Dog Breeds

If your pet is a poodle or a Chihuahua, your home insurance company probably won’t bat an eye. However, owning a pit bull, Rottweiler, or other dangerous breeds may make it difficult—in some cases, impossible—to find home insurance coverage. Depending on your location, insurer, and other factors, home insurance exclusions may apply to the following dog breeds:

- Pit bulls

- Staffordshire Terriers

- Doberman Pinschers

- Rottweilers

- Chows

- Akitas

- Presa Canarios

- Wolf-hybrids

If you own a “blacklisted” breed, you may be charged more for coverage or denied a policy altogether; you can ask your insurer to exclude your dog, in which case you’ll be financially responsible for any damage it causes.

4. Neglect

Insurers expect homeowners to care for their homes and repair minor problems. This includes sealing cracks, minimizing water damage, fixing damaged pipes, scheduling regular inspections, and more.

For example, if a storm causes your tree to fall onto your home, you’re probably covered. However, if your tree collapses onto your home because of a termite infection that went unchecked, you may be responsible for the resulting damage.

5. Sewage Backup

Infamous home insurance exclusions include sewer damage. For instance, if a toilet overflows and you have to hire a professional crew to mop up the mess, you’ll probably be left footing the bill. Sewage backup usually isn’t covered by home insurance unless you’ve purchased a separate rider.

6. Luxury Items

If you keep precious items in your home, you probably need to purchase additional theft liability coverage. According to the Insurance Information Institute, most standard home insurance policies only cover up to $1,500 for damage or theft. Items that may require additional coverage include:

- Jewelry

- Antiques

- High-end electronics

- Collectibles

Contact your home insurance agent if you have items that require additional coverage.

7. Power Outages

The most common and expensive damage occurs when power is restored, and a surge of electricity floods the home’s circuits. These electricity blasts can cause computers to lose information, electronic devices to overheat, and large appliances to malfunction. In addition to using surge protectors, home insurance companies expect homeowners to unplug all sensitive electronic appliances and leave them unplugged until power is restored.

8. Intentional Damage by a Resident

Intentional damage caused by a resident of the home is not covered by home insurance. For instance, if your teenage daughter purposely sets fire to your home after a heated argument, you’re on your own to cover the losses.

9. War, Terrorism, Nuclear Attacks

If your home is destroyed in a riot, you’re probably covered for the damages. But if a foreign army, terrorist attack, or nuclear meltdown damages or destroys your home, your home insurance policy won’t cover you.

10. Trampolines

Insurance companies consider trampolines to be an extreme risk to personal safety—and a lawsuit waiting to happen if a neighbor is injured while jumping on your trampoline. That’s why many home insurance companies refuse to extend coverage to trampolines, and your current insurer may threaten to cancel your policy if you purchase one.

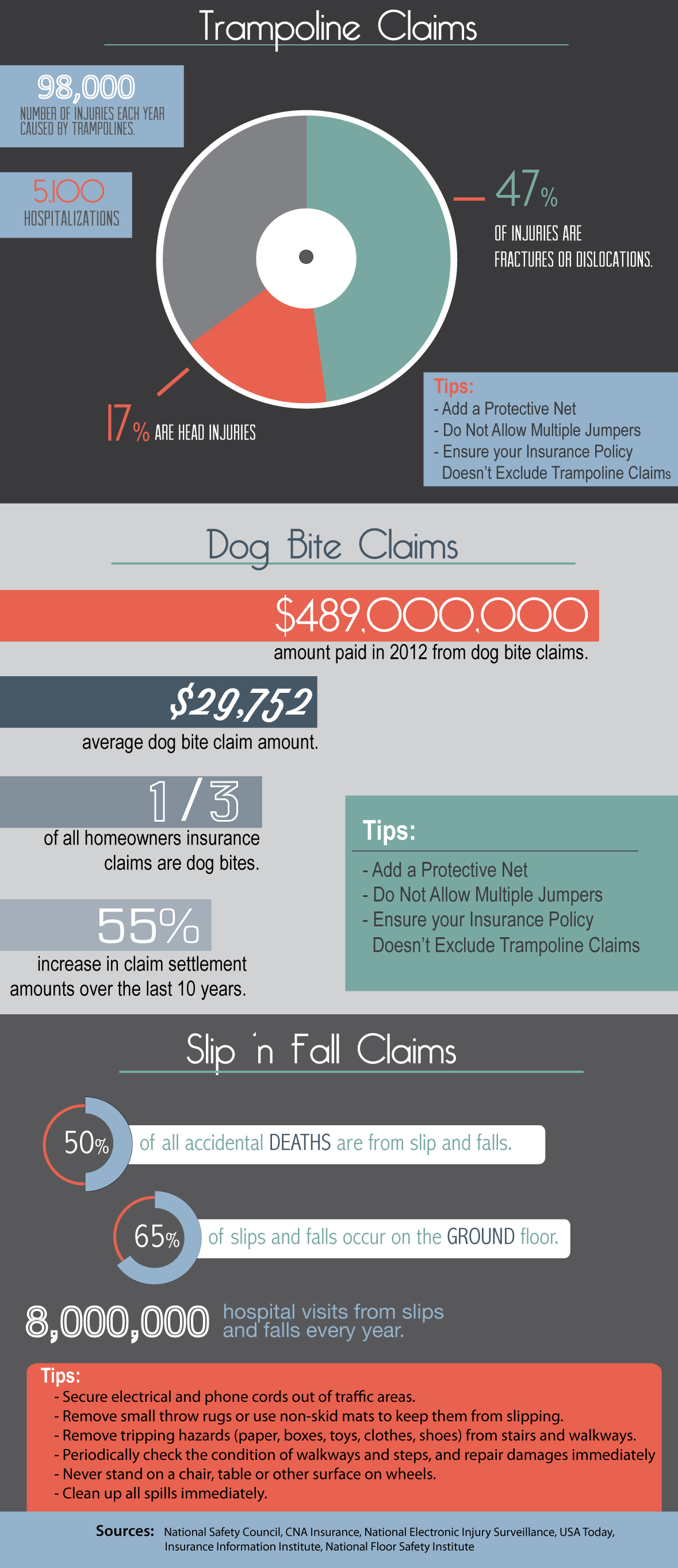

Litigation frequency and severity are increasing at dramatic rates. Thankfully, homeowners insurance can help protect you from many of these claims, but it is still shocking to see how expensive they can be.

For example, did you know that the average dog bite insurance claims now costs about $30,000 to settle? Or that half of all accidental deaths in the home are caused by slips and falls?

With these items in mind, we have compiled an infographic of the most common personal liability insurance claims with tips on how to avoid them.

If you want to make sure your homeowners insurance policy provides the necessary liability coverage and proper limits for these types of scenarios, please feel free to contact our office.

Content insurance protects your personal property when you rent an apartment, a condominium, or a home. The owner of the property is responsible for insuring the building itself and any appliances or fixtures provided to you as a renter. But, unless you buy contents or renter’s insurance, you will not have protection for damages or loss of your personal possessions.

What will Content Insurance cover?

As a renter, you need coverage for your personal property and liability protection if you’re responsible for injury to someone else. Content insurance pays for damage to, or the loss of, your personal possessions that are located within your residence. Some policies will also cover your personal possessions, such as laptops or golf clubs that you might have in your car. A renter’s policy will also include liability coverage for injuries. For example, if your dog bites your neighbor, you might need liability coverage.

Saving Money on Content Insurance

- Buy only as much coverage as you really need. Content coverage is for the actual replacement cost or your property’s actual cash value, not what you think it is worth. For example, a “priceless” family heirloom may have deep sentimental value, but your insurance will only pay for the cost to repair or replace it. Unfortunately, not all items can be replaced.

- Consider higher deductibles. If you are willing to accept responsibility for a larger part of each loss, your insurance premium will be lower.

- Reduce your risk. A sprinkler system or alarm system will reduce rates for most policies. And, if you have a dog that’s considered a “dangerous breed,” be aware that you may pay more.

- Ask for a discount on your auto insurance. Many auto insurers will give you a 5 or 10% discount on your car insurance when you insure your home or apartment with them. It’s worth it to check!

Complete a Home Inventory today

You’ll be surprised at what you have. A home inventory is the best way to document your personal property. Digital pictures or a quick video of each room and closet will help you get the most from your insurance policy if you ever have a loss.

If you would like to find out more about home contents insurance, please feel free to contact our office.

If you rent a house or apartment, your landlord’s insurance will only cover the costs of repairing the building if there is a fire or other disaster. There is no coverage provided to protect your personal property or negligence. You need your own coverage, known as renters or tenants insurance in order to financially protect yourself and your belongings.

- Coverage for Personal Possessions

- Liability Protection

- Additional Living Expenses

The following is a brief overview of what renter’s insurance is and how it can protect you.

- Determining a limit. The first step to insuring your personal possessions is to determine an appropriate limit to replace everything in the even of a total loss due a fire or other covered calamity. The quickest way to do this is by preforming a home inventory. A home inventory will provide a detailed list of all your belongings and associated value.

- Type of coverage. There are two types of coverages available on a standard policy: replacement cost and actual cash value. Replacement cost pays for the cost to replace your property with like kind and quantity. Actual cash value pays to replace your possessions minus a deduction for depreciation.

- What disasters are covered? A standard renters insurance covers you against losses from fire or smoke, lightning, vandalism, theft, explosion, windstorm and certain types of water damage (such as when the tenant upstairs leaves the water running in the bathtub and floods out your apartment or a burst pipe). Every policy will have a variety of exclusions with the two most prevalent being flood and earthquake.

- What is a “floater” and do I need one? If you have expensive jewelry, furs, sports or musical equipment, or expensive electronics like a laptop, consider adding a floater to your policy. Most standard renters policies offer only a limited dollar amount for such items; a floater is a separate policy that provides additional insurance for your valuables and covers them if they are accidentally lost. .

- Determining a limit. Liability coverage protects you against bodily injury or property damage caused to others due to your negligence. It pays for both the cost of defending you in court and court awards—up to the limit of your policy. Most standard renters insurance policies will generally provide at least $100,000 of liability coverage, but additional amounts are available.

- What about an umbrella? If you need a higher liability limit, you can purchase a personal umbrella liability policy. An umbrella policy kicks in when you reach the limit on the underlying liability coverage provided by your renters or auto policy. To purchase an umbrella policy, most insurance companies will require higher limits of liability on both your home and auto insurance.

- What happens if I can’t live in my home due to a disaster? If your home is destroyed by a covered claim and you need to live elsewhere, renters insurance provides additional living expenses (ALE). ALE pays for hotel bills, temporary rentals, restaurant meals and other expenses you incur while your home is being repaired or rebuilt.

- Have a security system

- Use smoke detectors

- Use deadbolt locks

- Have good credit

- Have multiple policies

- Stay with the same insurer

- Are over 55 years old

According to the FBI, did you know that insurance fraud costs insurance companies (and ultimately consumers) more than $50 billion each year? This equates to approximately $500 in increased annual premiums for each one of us.

Plus, when you start adding lost productivity for businesses, ruined family finances, and the cost to investigate and prosecute, the total figure is probably much higher.

For the most part, these fraudsters aren’t criminal masterminds. Here are five of the craziest insurance fraud scams we have ever encountered, from phony slip-and-falls to fake deaths to desperate business owners.

Unfortunately for them, police were able to salvage the footage from the damaged security tapes. They showed the men entering their own safe and removing all the jewelry two hours before the supposed burglary.

Unfortunately for him, the whole charade was caught on tape. According to Assistant District Attorney Linda Montag, the accident was a tiny tap by a taxicab. There wasn’t even a scratch on the bus.

An investigation by detectives from the Philadelphia District Attorney’s Insurance Fraud Unit revealed Parker used as many as 47 aliases and 11 different addresses to file her claims, which totaled more than $500,000.