If you are looking for Arvada Life Insurance Quotes, then The Holste Agency can help you out. Our expert staff can guide you through the Arvada Life Insurance options available to you and your family. Additionally, we can help you calculate a proper limit, obtain multiple quotes, and purchase the policy that fits best.

Arvada Life Insurance will protect you and your family from unexpected tragedy by providing the financial assistance you need.

If you have any questions or you would like to receive a quote, please feel free to contact our office.

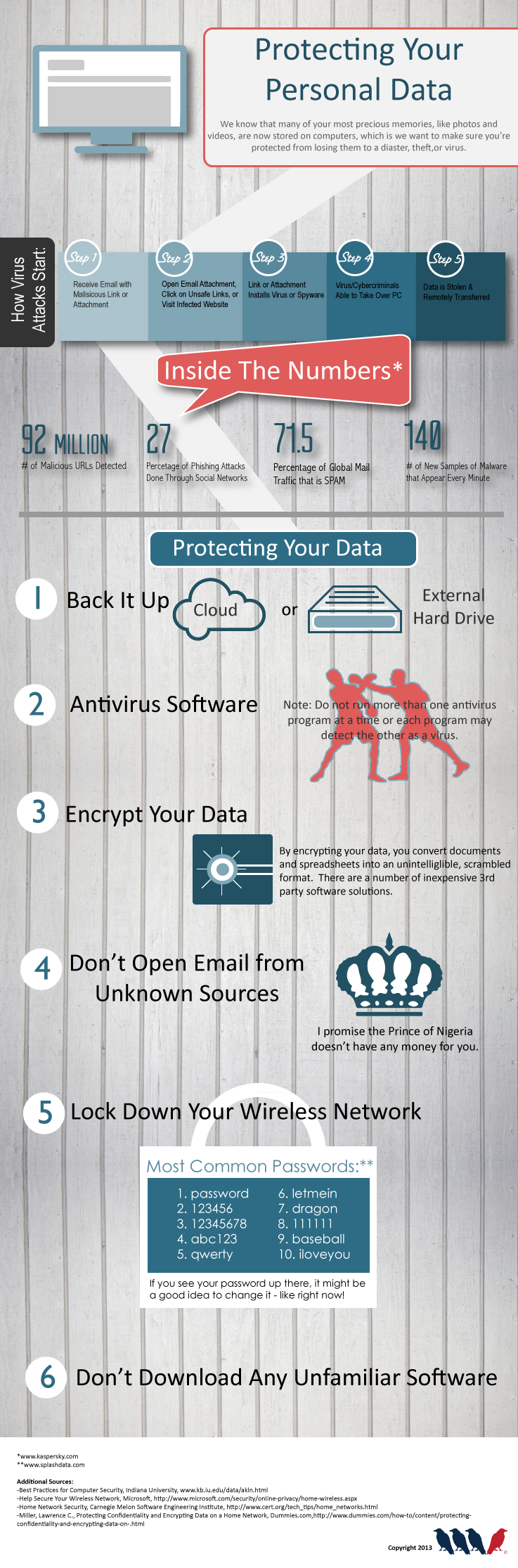

Have you ever thought about what you would do if you lost all of your family photos or videos due to a problem with your computer? Or what if your hard drive failed, causing you to lose all of your saved data?

As your insurance agent, our goal is to protect those items that are most valuable to you. And what is more valuable than the information many of us store on our home computers?

Knowing that families’ most precious memories like photos and videos are stored on computers now, we have put together an infographic with tips and tricks to protecting your personal data.

Within this guide you will find advice on how to ensure that some of your most precious assets are never lost or destroyed.