Did you know almost 60% Americans don’t own any type of life insurance policy? This is according to the latest study done by the Life and Health Insurance Foundation for Education (www.lifehappens.org).

Life insurance allows your spouse and/or family to receive money to help offset funeral expenses, lost income, and future financial needs.

Purchasing the right policy can be a daunting process, though, which is why we wanted to include what we feel are our top tips to buying a life insurance policy.

If, as you read this information, you have any questions or would like life insurance quotes to evaluate your options, please contact our office.

Why Should I Buy Life Insurance?

If someone depends on your income for their livelihood, like a spouse or child, then you should strongly consider buying life insurance. Life insurance provides the financial support families need if a loved one were to pass away unexpectedly.

How Much Life Insurance Should I Buy?

Figuring out the right limit to use depends upon a variety of factors. Lost income, funeral expenses, college expenses, mortgage loans, consumer debt balances, and additional expenses are just some of the elements you should consider as you evaluate how much to purchase. There are a number of life insurance calculators available to assist you with this process for free.

Which Type of Policy is Right for Me?

There are four basic types of life insurance to choose from; depending upon your financial situation, investment aspirations, and desired limit, some options will work better than others.

The four types of policies are term life, whole life, universal life, and variable life.

Term Life Insurance. Term life insurance, just as its name implies, is a policy that has a specified “term” to the policy. Typical terms are 10, 20, or 30 year, and it is the most common form of life insurance.

Term policies are typically the LEAST expensive because they only provide insurance protection and they do not accumulate cash value. Many term policies include the flexibility to convert them into whole life policies as the individual’s income and needs change.

Whole Life Insurance. Whole life insurance, also known as permanent insurance, provides protection through your entire lifetime. As long as you pay your premiums the policy will never expire, regardless of your health condition.

Another major difference between whole life and term is it accumulates a cash value that can be borrowed against or withdrawn. However, because of these two major differences the premiums for a whole life policy are higher than those of a term policy.

Universal Life Insurance. Universal life insurance is similar to whole life insurance in that it provides protection throughout your lifetime and accumulates a cash value. Where it differs, though, is in its flexibility with limits and premiums.

Universal life insurance actually gives you the freedom to increase or decrease your coverage and control the amount and frequency of your premium payments as your insurance and financial needs change.

Variable Universal Life. Variable Universal Life is very similar to universal life with one major addition: variable universal life policies allow policy owners to apply their premium dollars to a variety of investment options. This option offers the possibility for an increased rate of return over a normal universal or permanent policy, but that means it is also subject to market risks associated with investing.

How do I know if the policy I buy is from a reputable insurance company? The policy you buy is only as good as the company insuring it. You need to know the company will be around if you need it to pay a death claim. There are actually a few different rating agencies that rate insurance companies on their overall financial strength and their ability to pay claims. A.M Best, Standard and Poor’s, Moody’s, and Fitch are all companies that independently evaluate the financial soundness of insurance agencies and assigned them ratings based upon their findings.

Each company rates insurance companies a little differently so you may want to look at multiple ratings as you select a company. You will want to look for an “A” (or AAA depending upon the rating agency) rating and a positive financial outlook to help ensure you select a financially secure insurance company.

How should I purchase my policy?

While you can certainly purchase life insurance online, we recommend working with a life insurance expert or financial planner. Working with a specialist can help you determine the right life insurance product and select adequate policy limits.

Also, by working with a licensed agent it will be much easier to make changes to your policy and receive guidance and answers to your questions as your needs change.

What kind of questions should I ask?

A lot of people simply don’t know what questions they should ask in regards to their life insurance. You should make sure you clearly understand the product you are purchasing, which is why we’ve included a few examples of questions you should be ready to ask.

- Is the policy renewable?

- Can the policy be canceled?

- Can I make changes to the policy?

- How long is the premium guaranteed for?

- Are there any special policy provisions?

- What are the exclusions on the policy?

What can I do to help reduce premiums?

There are actually a number of things you can do to help save on your premiums aside from reducing limits or changing insurance products. Since your current health condition is one of the primary factors used to determine your premium, any changes you can make to move yourself into a “preferred” or “super-preferred” risk class will greatly reduce your premium.

To do so, though, may involve losing weight, exercising, quitting smoking, or lowering cholesterol and blood pressure. And, while it may take some work, moving into the more “preferred” risk classes can save you tens of thousands of dollars over the life of a policy.

Should I always keep the same policy?

Financial situations and family additions are just a couple of reasons why you should evaluate your life insurance needs every few years. Income growth and additional children can significantly affect the limit and type of policy that will fit your situation. We recommend working closely with an agent or financial advisor who understands how to properly address your changing needs.

*The above information is to be used as guidance only, and should not be considered as definite in any particular case. Every policy is different and you need to read through your policy and consult with your agent to best determine how your coverage will respond. Within this article we simply cannot analyze every possible loss exposure and exception to the general guidelines above.

9 Ways to Lower Your Homeowners Insurance Costs

Arvada Insurance, Blog, Denver Metro InsuranceWe are frequently asked what consumers can do to lower their homeowners insurance premiums. The following tips will hopefully help provide some guidance on saving money without sacrificing coverage:

1. Raise Your Deductible

Deductibles are the amount of money you have to pay toward a loss before your insurance company starts to pay a claim, according to the terms of your policy. The higher your deductible, the more money you can save on your premiums. Nowadays, most insurance companies recommend a deductible of at least $500. If you can afford to raise your deductible to $1,000, you may save as much as 25 percent. Remember, if you live in a disaster-prone area, your insurance policy may have a separate deductible for certain kinds of damage.

2. Purchase Price vs. Rebuilding Costs

The land under your house isn’t at risk from theft, windstorm, fire and the other perils covered in your homeowners policy. So don’t include its value in deciding how much homeowners insurance to buy. If you do, you will pay a higher premium than you should.

3. Multi-policy Discounts

Some companies that sell homeowners, auto and liability coverage will take 5 to 15 percent off your premium if you buy two or more policies from them. But make certain this combined price is lower than buying the different coverages from different companies.

4. Disaster Proof

Find out from your insurance agent or company representative what steps you can take to make your home more resistant to windstorms and other natural disasters. You may be able to save on your premiums by adding storm shutters, reinforcing your roof or buying stronger roofing materials. Older homes can be retrofitted to make them better able to withstand earthquakes. In addition, consider modernizing your heating, plumbing and electrical systems to reduce the risk of fire and water damage.

5. Home Security

You can usually get discounts of at least 5 percent for a smoke detector, burglar alarm or dead-bolt locks. Some companies offer to cut your premium by as much as 15 or 20 percent if you install a sophisticated sprinkler system and a fire and burglar alarm that rings at the police, fire or other monitoring stations. These systems aren’t cheap and not every system qualifies for a discount. Before you buy such a system, find out what kind your insurer recommends, how much the device would cost and how much you’d save on premiums.

6. Good Credit

Establishing a solid credit history can cut your insurance costs. Insurers are increasingly using credit information to price homeowners insurance policies. To protect your credit standing, pay your bills on time, don’t obtain more credit than you need and keep your credit balances as low as possible. Check your credit record on a regular basis and have any errors corrected promptly so that your record remains accurate.

7. Longevity

If you’ve kept your coverage with a company for several years, you may receive a special discount for being a long-term policyholder. Some insurers will reduce their premiums by 5 percent if you stay with them for three to five years and by 10 percent if you remain a policyholder for six years or more. But make certain to periodically compare this price with that of other policies.

8. Policy Review

You want your policy to cover any major purchases or additions to your home. But you don’t want to spend money for coverage you don’t need. If your five-year-old fur coat is no longer worth the $5,000 you paid for it, you’ll want to reduce or cancel your floater (extra insurance for items whose full value is not covered by standard homeowners policies such as expensive jewelry, high-end computers and valuable art work) and pocket the difference.

9. Private insurance vs. Federally-Issued Insurance

If you live in a high-risk area — say, one that is especially vulnerable to coastal storms, fires, or crime — and have been buying your homeowners insurance through a government plan, you should check with an insurance agent or company representative or contact your state department of insurance for the names of companies that might be interested in your business. You may find that there are steps you can take that would allow you to buy insurance at a lower price in the private market.

Winterizing Your Home

Arvada Insurance, Blog, Denver Metro InsuranceAs we’re now in the middle of winter, we know that a variety of problems can arise during these months due to the weather. The importance of maintaining your home during these months can protect you from potentially large insurance claims.

For example, did you roof damage accounts for almost 50% of all homeowners claims? As the largest single surface and the first line of defense in protecting your, it’s vital that you regularly inspect it. States with snow are especially at risk because of the weight of rain and snow upon the structure.

To find out more about preventing winter-related claims in your home, please contact our office to find out more.

Carbon Monoxide Safety Tips

Arvada Insurance, Blog, Denver Metro InsuranceWith winter quickly approaching it won’t be too long before the freezing weather and snow are here. As the primary months when consumers crank up their furnaces and portable heaters, November, December, and January account for nearly two-thirds of all non-fire carbon monoxide (CO) related deaths.

In fact, according to the Center for Disease Control, this invisible killer accounts for over 500 CO deaths plus thousands of hospital visits each year. The unfortunate part is that most of these tragic deaths could be prevented by implementing some basic safety measures. With that in mind, we want to share some insight into what CO poisoning is, how it affects your body, and what you and your family can do to ensure you are protected.

Also, as a final note, many insurance companies will provide discounts for properly installing both fire and carbon monoxide alarms. To find out more, please contact our office.

Carbon Monoxide Safety Tips

What Is Carbon Monoxide (CO)?

Carbon monoxide (CO) is an odorless, colorless gas that interferes with the delivery of oxygen in the blood to the rest of the body.

What Are the Major Sources of CO?

Carbon monoxide is produced as a result of incomplete burning of carbon-containing fuels including coal, wood, charcoal, natural gas, and fuel oil. It can be emitted by combustion sources such as unvented kerosene and gas space heaters, furnaces, woodstoves, gas stoves, fireplaces and water heaters, and automobile exhaust from attached garages. Problems can arise as a result of improper installation, maintenance, or inadequate ventilation.

What Are the Health Effects?

Carbon monoxide interferes with the distribution of oxygen in the blood to the rest of the body. Depending on the amount inhaled, this gas can impede coordination, worsen cardiovascular conditions, and produce fatigue, headache, weakness, confusion, disorientation, nausea, and dizziness. Very high levels can cause death.

The symptoms are sometimes confused with the flu or food poisoning. Fetuses, infants, elderly, and people with heart and respiratory illnesses are particularly at high risk for the adverse health effects of carbon monoxide.

What Can Be Done to Prevent CO Poisoning?

What about Carbon Monoxide Detectors?

Carbon monoxide (CO) detectors can be used as a backup but not as a replacement for proper use and maintenance of your fuel-burning appliances. CO detector technology is still being developed and the detectors are not generally considered to be as reliable as the smoke detectors found in homes today. You should not choose a CO detector solely on the basis of cost; do some research on the different features available.

Carbon monoxide detectors should meet Underwriters Laboratories Inc. standards, have a long-term warranty, and be easily self-tested and reset to ensure proper functioning. For maximum effectiveness during sleeping hours, carbon monoxide detectors should be placed close to sleeping areas.

If your CO detector goes off, you should:

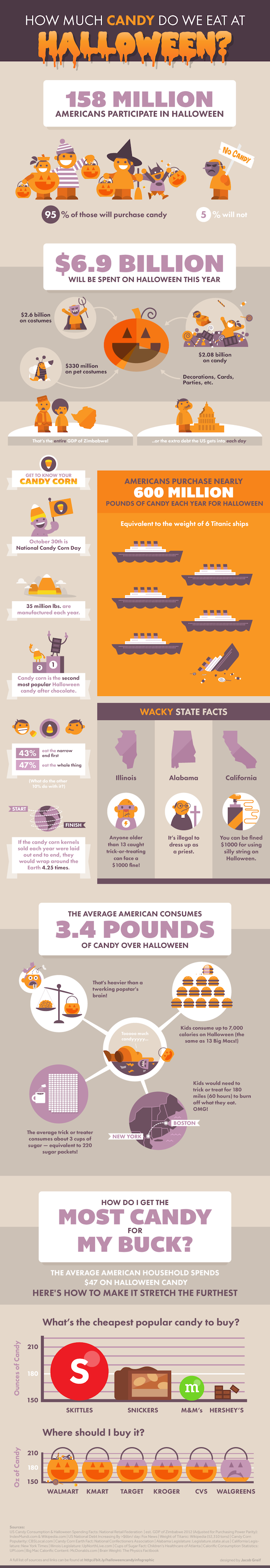

Halloween Infographic and Safety Tips

Blog, Safety TipsDid you know that over $2 billion will be spent on Halloween candy this year? Or how about $330 million on just pet costumes?

We know that Halloween is one of children’s favorite holidays. The chance to dress up in a costume and fill bags with candy is a sure way to excite any youngster. (Plus, the fact that the average trick-or-treater consumes the equivalent of 220 packets of sugar on this holiday doesn’t hurt either.) For parents, though, the night can be a little stressful as you worry about your kids’ safety.

With that in mind, we have compiled an infographic with 31 interesting statistics and facts associated with Halloween along with a brief list of safety tips. We encourage you to take a look at it just in case there is a tip or two that will help you avoid any potential accidents or danger.

Halloween Infographic

Safety Tips

Trick-or-treating

Costumes

Candy

Adults

Life Insurance Purchasing Guide

Arvada Insurance, Blog, Denver Metro InsuranceDid you know almost 60% Americans don’t own any type of life insurance policy? This is according to the latest study done by the Life and Health Insurance Foundation for Education (www.lifehappens.org).

Life insurance allows your spouse and/or family to receive money to help offset funeral expenses, lost income, and future financial needs.

Purchasing the right policy can be a daunting process, though, which is why we wanted to include what we feel are our top tips to buying a life insurance policy.

If, as you read this information, you have any questions or would like life insurance quotes to evaluate your options, please contact our office.

Why Should I Buy Life Insurance?

If someone depends on your income for their livelihood, like a spouse or child, then you should strongly consider buying life insurance. Life insurance provides the financial support families need if a loved one were to pass away unexpectedly.

How Much Life Insurance Should I Buy?

Figuring out the right limit to use depends upon a variety of factors. Lost income, funeral expenses, college expenses, mortgage loans, consumer debt balances, and additional expenses are just some of the elements you should consider as you evaluate how much to purchase. There are a number of life insurance calculators available to assist you with this process for free.

Which Type of Policy is Right for Me?

There are four basic types of life insurance to choose from; depending upon your financial situation, investment aspirations, and desired limit, some options will work better than others.

The four types of policies are term life, whole life, universal life, and variable life.

Term Life Insurance. Term life insurance, just as its name implies, is a policy that has a specified “term” to the policy. Typical terms are 10, 20, or 30 year, and it is the most common form of life insurance.

Term policies are typically the LEAST expensive because they only provide insurance protection and they do not accumulate cash value. Many term policies include the flexibility to convert them into whole life policies as the individual’s income and needs change.

Whole Life Insurance. Whole life insurance, also known as permanent insurance, provides protection through your entire lifetime. As long as you pay your premiums the policy will never expire, regardless of your health condition.

Another major difference between whole life and term is it accumulates a cash value that can be borrowed against or withdrawn. However, because of these two major differences the premiums for a whole life policy are higher than those of a term policy.

Universal Life Insurance. Universal life insurance is similar to whole life insurance in that it provides protection throughout your lifetime and accumulates a cash value. Where it differs, though, is in its flexibility with limits and premiums.

Universal life insurance actually gives you the freedom to increase or decrease your coverage and control the amount and frequency of your premium payments as your insurance and financial needs change.

Variable Universal Life. Variable Universal Life is very similar to universal life with one major addition: variable universal life policies allow policy owners to apply their premium dollars to a variety of investment options. This option offers the possibility for an increased rate of return over a normal universal or permanent policy, but that means it is also subject to market risks associated with investing.

How do I know if the policy I buy is from a reputable insurance company? The policy you buy is only as good as the company insuring it. You need to know the company will be around if you need it to pay a death claim. There are actually a few different rating agencies that rate insurance companies on their overall financial strength and their ability to pay claims. A.M Best, Standard and Poor’s, Moody’s, and Fitch are all companies that independently evaluate the financial soundness of insurance agencies and assigned them ratings based upon their findings.

Each company rates insurance companies a little differently so you may want to look at multiple ratings as you select a company. You will want to look for an “A” (or AAA depending upon the rating agency) rating and a positive financial outlook to help ensure you select a financially secure insurance company.

How should I purchase my policy?

While you can certainly purchase life insurance online, we recommend working with a life insurance expert or financial planner. Working with a specialist can help you determine the right life insurance product and select adequate policy limits.

Also, by working with a licensed agent it will be much easier to make changes to your policy and receive guidance and answers to your questions as your needs change.

What kind of questions should I ask?

A lot of people simply don’t know what questions they should ask in regards to their life insurance. You should make sure you clearly understand the product you are purchasing, which is why we’ve included a few examples of questions you should be ready to ask.

What can I do to help reduce premiums?

There are actually a number of things you can do to help save on your premiums aside from reducing limits or changing insurance products. Since your current health condition is one of the primary factors used to determine your premium, any changes you can make to move yourself into a “preferred” or “super-preferred” risk class will greatly reduce your premium.

To do so, though, may involve losing weight, exercising, quitting smoking, or lowering cholesterol and blood pressure. And, while it may take some work, moving into the more “preferred” risk classes can save you tens of thousands of dollars over the life of a policy.

Should I always keep the same policy?

Financial situations and family additions are just a couple of reasons why you should evaluate your life insurance needs every few years. Income growth and additional children can significantly affect the limit and type of policy that will fit your situation. We recommend working closely with an agent or financial advisor who understands how to properly address your changing needs.

*The above information is to be used as guidance only, and should not be considered as definite in any particular case. Every policy is different and you need to read through your policy and consult with your agent to best determine how your coverage will respond. Within this article we simply cannot analyze every possible loss exposure and exception to the general guidelines above.

Shopping for a Safe Car

Arvada Insurance, Blog, Denver Metro InsuranceHow to Assess Your Homeowners Insurance

Arvada Insurance, Blog, Denver Metro InsuranceOne of the biggest concerns we have as insurance agents is ensuring your home has the right type of coverage and limits to ensure you are properly protected. Being properly insured and knowing the value of the home and possessions can provide some peace of mind during what could be an extremely stressful period.

We recommend reviewing your insurance policy annually to make sure you current coverage is sufficient. As you do so you want to make sure you will be in the same position prior to suffering the loss. For example if you have to rebuild your home, you will want to make sure you have full replacement cost coverage for your home.

As you review your policy, here are the main areas to focus:

1. Rebuilding Your Home

Make sure you enough coverage to rebuild your home if it was completely destroyed. This should include items like building material, appliances, fixtures and even the ability to tear our existing debris. Depending on your location and the housing market, sometimes the rebuilding costs can be more than your home’s market value.

2. Replacing Your Possessions

Most contents coverage is included on your insurance policy as a percentage of the structure’s value. It’s important to check that you have replacement cost coverage as opposed to actual cash value coverage. Replacement cost coverage will reimburse you to replace the damaged property with like kind and quality where as actual cash value will only pay the value of the destroyed property after deducting depreciation costs.

When you do have to make a claim, some companies will require you to itemize everything you had before they pay anything. Since remembering what you own can be difficult during what’s already a stressful time, experts suggest routinely doing an inventory of your home.

Taking pictures or videos of your home and contents is an easier way to remember than itemizing everything on a piece of paper. There are also free online tools available to assist with this as well.

3. Liability

Most companies start out with $100,000 of liability coverage in a plan. Homeowner’s generally have more risk than they realize, especially if they have a pool, trampoline, young drivers or pets that could bite someone, for example.

It’s also important to consider an umbrella policy as well that will typically provide up to an additional $1,000,000 in coverage above your homeowners policy.

To find out if your insurance policy is providing the right coverage, please reach out to our office to find out more.

How to Properly Insure Jewelry

Arvada Insurance, Blog, Denver Metro InsuranceInsuring Jewelry

Knowing how much personal property coverage you have on your homeowners or renters policy is a good place to start with insuring jewelry. Most of the time, you’ll be covered up to a certain limit if it is stolen ($2,500 total). But with the average value of an engagement ring in the US costing around $5,000, homeowners insurance policies will most likely not cover the full value.

Since your standard policy most likely only covers part of your jewelry’s cost (and there’s usually no coverage for items that are lost or damaged), you may have to add additional coverage to insure the full cost should you ever need to replace your jewelry. This is done through a personal articles floater attached to your homeowners policy.

For high valued items, like engagement rings, the item is on a “schedule” and insured separately. Usually you can expect to pay around $1-2 per $100 of the item value. If the ring or piece of jewelry is brand new, the receipt from purchase can help determine the value.

Prior insurance carrier declarations are also good documentation to have on hand if your jewelry has been previously insured. It’s a good idea to get a professional written jewelry appraisal done to make sure that the item is being insured at its correct value. This is especially true if the jewelry is an heirloom or hasn’t recently been purchased.

Remember that the value of jewelry can change over time. It is important to have a recent appraisal done every 2-3 years and update your policy when the value of jewelry changes to ensure adequate coverage.

Another important factor is insuring your new jewelry in a timely fashion. You’ll want to make sure you’re covered even if something were to happen in the days after purchasing or receiving it as a gift.

Once you have jewelry insurance, keep your current appraisal, policy information, and any documentation about the piece in a safe place should you ever need to make a claim. It’s recommended you also take pictures of the pieces (which should be included in a professional written appraisal).

*The above information is to be used as guidance only, and should not be considered as definite in any particular case. Every policy is different and you need to read through your policy and consult with your agent to best determine how your coverage will respond. Within this article we simply cannot analyze every possible loss exposure and exception to the general guidelines above.

What is Rental Dwelling Insurance?

Arvada Insurance, Blog, Denver Metro InsuranceWe are finding that more and more of our clients are renting out their homes on either a short- or long-term basis. It could be a second home, an investment property, or even the basement or a spare room in your house. Depending upon the rental scenario, your homeowners insurance policy may not properly cover you. You will need a more specialized policy.

Short-Term Rentals/Primary Residence

If you are planning to rent out all or part of your primary residence for a short period of time, for instance, a week or several weekends, there will likely be two insurance scenarios.

Some insurance companies may allow a policyholder a short-term rental. Other companies will require an endorsement to the existing policy to provide the proper coverage. If you plan to rent our your primary residence on a regular basis for short periods (think Airbnb), then this is considered a business for insurance purposes and will not be covered by your homeowners insurance policy. Proper coverage would require the purchase of a business policy.

Long-Term Rentals/Second Home

If you are looking to rent out your home for longer periods of time like six months to a year, you will likely need a rental dwelling policy. (This would also include vacation homes and investment properties.) Rental dwelling policies provide the proper protection for landlords on their properties, and typically cost about 25 percent more due to the increased risks.

Rental dwelling policies provide property insurance coverage for physical damage to the structure of the home plus coverage for personal property left on site for maintenance or tenant use like appliances or yard equipment.

The standard policy will also include liability coverage if a tenant or guest is injured while on the property. It will also cover legals fees and medical expenses.

Most rental dwelling policies also provide coverage for the loss of rental income while the property is being repaired due to a covered loss.

Renters Insurance

As the landlord, your coverage is only on the structure itself and your financial interest in it. Your tenant’s personal possessions are not covered under your policy. In order to avoid disputes in the event of damage to the renter’s belongings, many landlords require a tenant to buy renters insurance before signing a lease.

How is the value of my car determined in a claim?

Arvada Insurance, Blog, Denver Metro InsuranceOne of the most stressful situations people encounter with auto claims is determining the value of the vehicle or damage.

The Process

When you file your claim it will be referred to a claims adjuster who will verify the loss and determines the costs to make the necessary repairs. The estimate provided by the adjuster can then serve as a benchmark to do your own comparisons.

Insurance companies will not require you to sign an agreement accepting their estimate as total claim payment until you feel comfortable with the offer. If you are not satisfied with the provided estimate, then it is highly recommended that you get at least one estimate from a trusted mechanic.

While your insurance company cannot require you to have repairs done at a particular shop, they can require you to obtain more than one estimate for the damage. The insurance company will want to verify they are not overpaying for the damages.

Don’t be surprised when your insurance company chooses to pay for the lowest bid. Remember you don’t have to accept the lowest bid, but that you will need to prove that bid doesn’t adequately provide the necessary repairs.

Also, one of the reasons why your bid may be lower than anticipated because of betterment. Betterment is when repairs performed actually increase the value of your vehicle leaving you in a better position than before your claim.

It is up to your insurer to decide whether to pay for repairing your car or to declare it a total loss and pay you its book value. Most standard auto policies will not pay to repair a vehicle if the repairs cost more than the cash value assigned to the car.

There won’t be any dispute about whether to repair the car if it was completely totaled. But you may argue about what the pieces of the car were worth when they were assembled as a car. There are several standard guidelines used to determine the value of a vehicle. Guides published by the National Association of Automobile Dealers and Kelly Blue Book are good places to start.