Posts

In addition to being more cautious while driving in adverse weather, motorists should know the safety rules for dealing with winter road emergencies. Since road conditions can also change quickly in winter, drivers need to be aware of situations and surroundings and be prepared to react more quickly than in other driving scenarios. Extreme temperatures may also impact vehicle function.

Below you will find some additional information on navigating your vehicle in winter weather. If you do happen to experience an accident, please don’t hesitate to reach out to our office.

Winter Driving

- Avoid driving while you’re fatigued. Getting the proper amount of rest before taking on winter weather tasks reduces driving risks.

- Never warm up a vehicle in an enclosed area, such as a garage.

- Make certain your tires are properly inflated.

- Never mix radial tires with other tire types.

- Keep your gas tank at least half full to avoid gas line freeze-up.

- If possible, avoid using your parking brake in cold, rainy, and snowy weather.

- Do not use cruise control when driving on any slippery surface (wet, ice, sand).

Tips for long-distance winter trips:

- Watch weather reports before a long-distance drive or before driving in isolated areas—delay trips when terrible weather is expected. If you must leave, let others know your route, destination, and estimated time of arrival.

- Keep blankets, gloves, hats, food, water, and any needed medication in your vehicle.

- If you become snow-bound, stay with your vehicle. It provides temporary shelter and makes it easier for rescuers to locate you. Don’t try to walk in a severe storm. It’s easy to lose sight of your vehicle in blowing snow and become lost.

- Don’t overexert yourself if you try to push or dig your vehicle out of the snow.

- Tie a brightly colored cloth to the antenna or place a cloth at the top of a rolled-up window to signal distress. At night, keep the dome light on if possible. It only uses a small amount of electricity and will make it easier for rescuers to find you.

- Make sure the exhaust pipe isn’t clogged with snow, ice, or mud. A blocked exhaust could cause deadly carbon monoxide gas to leak into the passenger compartment with the engine running.

- Use whatever is available to insulate your body from the cold. This could include floor mats, newspapers, or paper maps.

- If possible, run the engine and heater just long enough to remove the chill and conserve gasoline.

Tips for driving in the snow:

- Accelerate and decelerate slowly. Applying the gas slowly to accelerate is the best method for regaining traction and avoiding skids. Don’t try to get moving in a hurry. And take time to slow down for a stoplight. Remember: It takes longer to slow down on icy roads.

- Drive slowly. Everything takes longer on snow-covered roads. Accelerating, stopping, turning – nothing happens as quickly as on dry pavement.

The normal dry pavement following three to four seconds should be increased to eight to ten seconds. This increased margin of safety will provide the longer distance needed if you have to stop. - Know your brakes. Whether you have antilock brakes or not, the best way to stop is threshold breaking. Keep the heel of your foot on the floor and use the ball of your foot to apply firm, steady pressure on the brake pedal.

- Don’t stop if you can avoid it. There’s a big difference in the amount of inertia it takes to start moving from a full stop versus how much it takes to get moving while still rolling. If you can slow down enough to keep rolling until a traffic light changes, do it.

- Don’t power up hills. Applying extra gas on snow-covered roads starts your wheels spinning. Try to get a little inertia going before you reach the hill and let that inertia carry you to the top. As you reach the crest of the hill, reduce your speed and proceed downhill as slowly as possible.

- Don’t stop going up a hill. There’s nothing worse than trying to get moving up a hill on an icy road. Get some inertia going on a flat roadway before you take on the hill.

Stay home. If you really don’t have to go out, don’t. Even if you can drive well in the snow, not everyone else can. Don’t tempt fate: If you don’t have somewhere you have to be, watch the snow from indoors.

One of the most stressful situations people encounter with auto claims is determining the value of the vehicle or damage.

The Process

When you file your claim it will be referred to a claims adjuster who will verify the loss and determines the costs to make the necessary repairs. The estimate provided by the adjuster can then serve as a benchmark to do your own comparisons.

Insurance companies will not require you to sign an agreement accepting their estimate as total claim payment until you feel comfortable with the offer. If you are not satisfied with the provided estimate, then it is highly recommended that you get at least one estimate from a trusted mechanic.

While your insurance company cannot require you to have repairs done at a particular shop, they can require you to obtain more than one estimate for the damage. The insurance company will want to verify they are not overpaying for the damages.

Don’t be surprised when your insurance company chooses to pay for the lowest bid. Remember you don’t have to accept the lowest bid, but that you will need to prove that bid doesn’t adequately provide the necessary repairs.

Also, one of the reasons why your bid may be lower than anticipated because of betterment. Betterment is when repairs performed actually increase the value of your vehicle leaving you in a better position than before your claim.

It is up to your insurer to decide whether to pay for repairing your car or to declare it a total loss and pay you its book value. Most standard auto policies will not pay to repair a vehicle if the repairs cost more than the cash value assigned to the car.

There won’t be any dispute about whether to repair the car if it was completely totaled. But you may argue about what the pieces of the car were worth when they were assembled as a car. There are several standard guidelines used to determine the value of a vehicle. Guides published by the National Association of Automobile Dealers and Kelly Blue Book are good places to start.

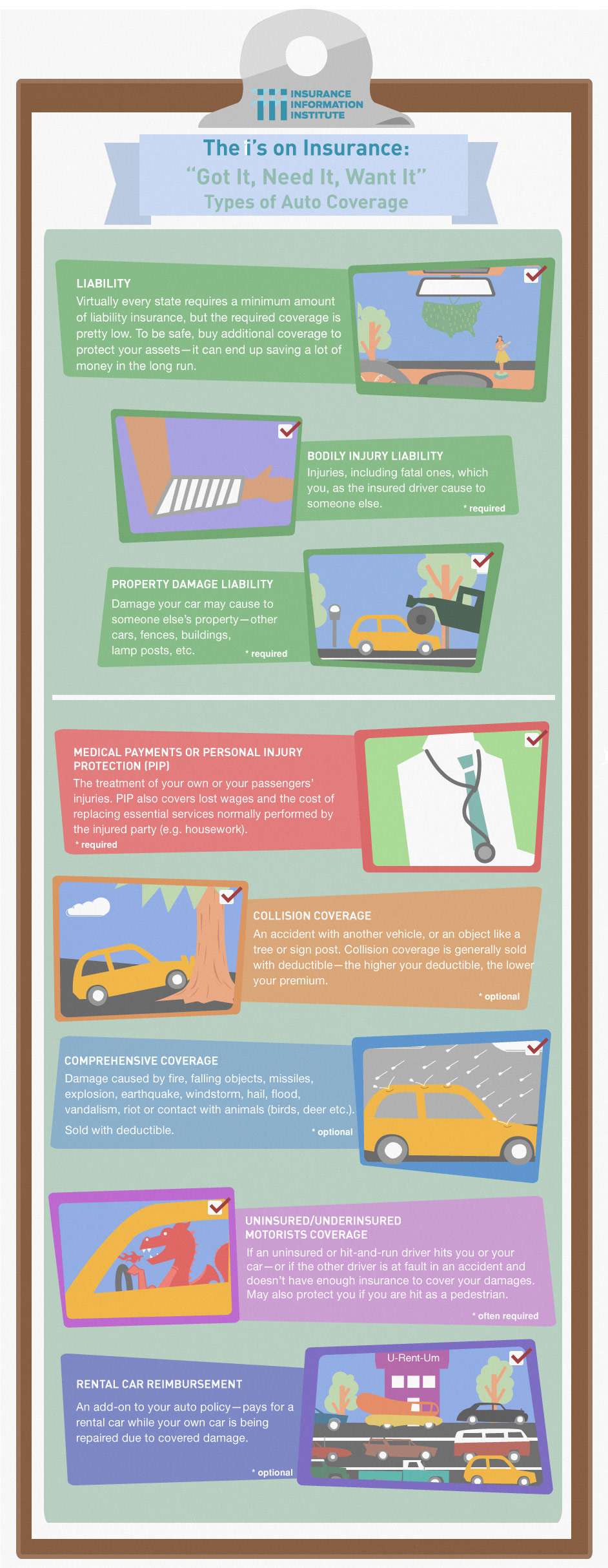

Customers often ask us exactly what each coverage on their auto insurance policy does. As policy language can be complicated and confusing, it can be difficult to understand how your policy is supposed to react in the event of a claim.

The Insurance Information Institute put together a nice infographic that outlines what each coverage is on an auto insurance policy and how it is designed to react in the event of a claim. As always, if you have any coverage questions at all, please feel free to give our office a call.