We know that homeowners insurance is designed to cover your home and it contents. Additionally, it provides liability protection for bodily injury and property damage for claims against you or members of your family. It may also provide coverage for the loss of use of your home in the event of a claim.

However, there are some unusual items that you may not realize might also be covered by your homeowners policy. The following seven claims are the most interesting claims we have seen successfully reimbursed by insurance companies.

It’s important to note, though, that every policy is different in coverage and the claims below may or may not be covered by your specific policy. If you have a question or concern in regards to your coverages, limits, etc., please feel free to give our office a call.

1. Eaten Jewelry

Although animals are typically excluded from coverage, there was a case where a dog allegedly ate a piece of jewelry and the insurance company offered to buy the dog at an unbelievably high price in an effort to salvage the jewelry.

After the owner refused, the insurance company finally relented and paid for the lost jewelry, which may or may not have been sitting in the dog’s stomach.

2. Bug-Repellent Basement

A homeowner had pesticide stored in the basement of his home. After a fire at the home, the homeowner noticed that swarms of flies would come in to the basement die almost immediately. After experts from Cornell University were brought in to assess the damage, it was determined that the chemical, when heated by fire, actually dissolved into the concrete and became even more potent. As the pesticide was also toxic to humans, the house had to be demolished and rebuilt from the basement up.

3. A Dump Truck

A homeowner owned a full-size dump truck that he used for nothing else but to move firewood to and from his wood-burning stove. As the vehicle was not registered for the road and used for property maintenance, the vehicle was covered by the homeowners policy as personal property after it was destroyed.

4. A Wedding Relocation

A homeowner was supposed to have a wedding in his backyard for his daughter. However, a fire forced them to relocate the wedding to a hotel. The homeowner was able to claim the increased cost of the wedding under the ‘loss of use’ coverage on his policy.

5. Bad Wine

After a backup of a sewage pipe caused flooding to home, the repair crew used heat to speed up the drying process. The homeowners’ wine cellar was heated to approximately 85 degrees for almost 10 days while the repairs were done.

The effect of the heat destroyed all of the wine and the insurance company reimbursed the homeowner.

6. Expensive Ingredients

Expensive cooking ingredients such as imported olive oil are covered at full value, as long as the homeowner is not running a business out of the home.

So if you’re doing a lot of shopping at Whole Foods, we recommend you keep your receipts.

7. Animal Stampede

A homeowner lived next door to an individual that owned cows, horses, and goats. One day something spooked the animals so bad that they ran through the neighbors fence and actually destroyed part of the insured’s home.

As the animals were not the homeowners, his insurance policy paid for the damage caused by the animals.

10 Ways Arvada and Denver Metro Residents Can Save on Home Insuranc

Arvada Insurance, Blog, Denver Metro InsuranceOver the past few weeks we have been providing tips and tricks for saving on auto insurance. So this week we thought we would provide the top ways you can save money on your home insurance.

The quickest way to save money on your home insurance is to take advantage of the discounts available to you. For example you may be able to add the following discounts to your policy:

Every insurance company offers different discounts, so we recommend working with an independent insurance agent to find out the what discounts are available to you.

In 2009, burglary victims (in all structures, including homes) lost an estimated $4.6 billion to property damage and theft, according to the FBI.

Your insurance provider may offer discounts if you install safety features. For example, security features like deadbolts, fire extinguishers, and security alarms can add discounts anywhere from 5 percent to 20 percent.

3. Raise your deductible

Raising your deductible is one surefire way to lower your monthly homeowners insurance premium. If you can afford to go slightly more out of pocket in the event of a claim, then you could potentially save another 10 to 15 percent.

Adding stronger weather-resistant features to your home like storm shutters or better roofing material can lead to dramatic savings on your insurance premiums, especially in areas that are prone to disasters like high winds or flooding.

We recommend reviewing your insurance policy every year to ensure that you not only have the right insurance coverage, but that you also aren’t purchasing unnecessary coverage as well.

This may sound obvious, but if you paid $200,000 for your house, you don’t need to have $200,000 worth of coverage, because part of the purchase price included the lot your house sits on. You should carry insurance coverage equal to the cost of rebuilding the structure.

7. Inventory your possessions

Understanding the right limit to use for your stuff can save you money on premiums and help you tremendously in the event of a claim.

Final Note

While it’s always nice to save money on your insurance, we don’t ever recommend purchasing liability and property limits at lower amounts than what will sufficiently protect you and your family. It’s never a good idea to put your personal assets in jeopardy to save $50 on your premiums.

If you would like to see where you can save more on your insurance premiums, or if you would like some insurance quotes on your home, please don’t hesitate to give us a call.

Infographic: Types of Auto Insurance

Arvada Insurance, BlogCustomers often ask us exactly what each coverage on their auto insurance policy does. As policy language can be complicated and confusing, it can be difficult to understand how your policy is supposed to react in the event of a claim.

The Insurance Information Institute put together a nice infographic that outlines what each coverage is on an auto insurance policy and how it is designed to react in the event of a claim. As always, if you have any coverage questions at all, please feel free to give our office a call.

7 Unusual Claims Covered by Homeowners Insurance

Arvada Insurance, Blog, Denver Metro InsuranceWe know that homeowners insurance is designed to cover your home and it contents. Additionally, it provides liability protection for bodily injury and property damage for claims against you or members of your family. It may also provide coverage for the loss of use of your home in the event of a claim.

However, there are some unusual items that you may not realize might also be covered by your homeowners policy. The following seven claims are the most interesting claims we have seen successfully reimbursed by insurance companies.

It’s important to note, though, that every policy is different in coverage and the claims below may or may not be covered by your specific policy. If you have a question or concern in regards to your coverages, limits, etc., please feel free to give our office a call.

1. Eaten Jewelry

Although animals are typically excluded from coverage, there was a case where a dog allegedly ate a piece of jewelry and the insurance company offered to buy the dog at an unbelievably high price in an effort to salvage the jewelry.

After the owner refused, the insurance company finally relented and paid for the lost jewelry, which may or may not have been sitting in the dog’s stomach.

2. Bug-Repellent Basement

A homeowner had pesticide stored in the basement of his home. After a fire at the home, the homeowner noticed that swarms of flies would come in to the basement die almost immediately. After experts from Cornell University were brought in to assess the damage, it was determined that the chemical, when heated by fire, actually dissolved into the concrete and became even more potent. As the pesticide was also toxic to humans, the house had to be demolished and rebuilt from the basement up.

3. A Dump Truck

A homeowner owned a full-size dump truck that he used for nothing else but to move firewood to and from his wood-burning stove. As the vehicle was not registered for the road and used for property maintenance, the vehicle was covered by the homeowners policy as personal property after it was destroyed.

4. A Wedding Relocation

A homeowner was supposed to have a wedding in his backyard for his daughter. However, a fire forced them to relocate the wedding to a hotel. The homeowner was able to claim the increased cost of the wedding under the ‘loss of use’ coverage on his policy.

5. Bad Wine

After a backup of a sewage pipe caused flooding to home, the repair crew used heat to speed up the drying process. The homeowners’ wine cellar was heated to approximately 85 degrees for almost 10 days while the repairs were done.

The effect of the heat destroyed all of the wine and the insurance company reimbursed the homeowner.

6. Expensive Ingredients

Expensive cooking ingredients such as imported olive oil are covered at full value, as long as the homeowner is not running a business out of the home.

So if you’re doing a lot of shopping at Whole Foods, we recommend you keep your receipts.

7. Animal Stampede

A homeowner lived next door to an individual that owned cows, horses, and goats. One day something spooked the animals so bad that they ran through the neighbors fence and actually destroyed part of the insured’s home.

As the animals were not the homeowners, his insurance policy paid for the damage caused by the animals.

Video: Questions Every Arvada and Denver Resident Should Ask About Insurance Before Buying a Home

Arvada Insurance, Denver Metro Insurance, Insurance Coverage TipsNew Technology that Helps You and Your Family Drive Safer

Arvada Insurance, Insurance Coverage TipsDistracted driving is quickly becoming one of the most dangerous hazards on the road, especially among teenage drivers. With auto insurance rates already high for these young drivers, it’s important that you try and avoid any potential insurance claims.

Chubb Insurance just released an article that highlights some of the available technologies to help your teen drivers avoid distracted driving and stay safe on the road. Some of the apps actually put a lock on the texting function while driving, while others monitor the driving behavior.

Here are some of the apps listed within the article:

DriveMode: This is a free app for Android and Blackberry users that actually responds to all incoming texts with a short message that the recipient is driving and will respond to them soon.

Canary: Canary is an app for both the iPhone and Android that allows parents to monitor their child’s cell phone usage in real time while driving. It records the times the cell phone is used and actually notifies parents if the child attempts to disable it.

TextBuster: Is a hardware device you actually install in your car the temporarily disables text messaging, email, and internet access while the driver is in the vehicle. It does, however, allow the phone to still make and receive phone calls and use the GPS.

iGuardian Teen: This is an Android app that actually shows parents what their child is doing in the car. It monitors driving speeds, distance traveled, and phone usage.

If you are in the Denver Metro or Arvada area and you are interest in how using these apps will help you qualify for insurance discounts, please give our office a call.

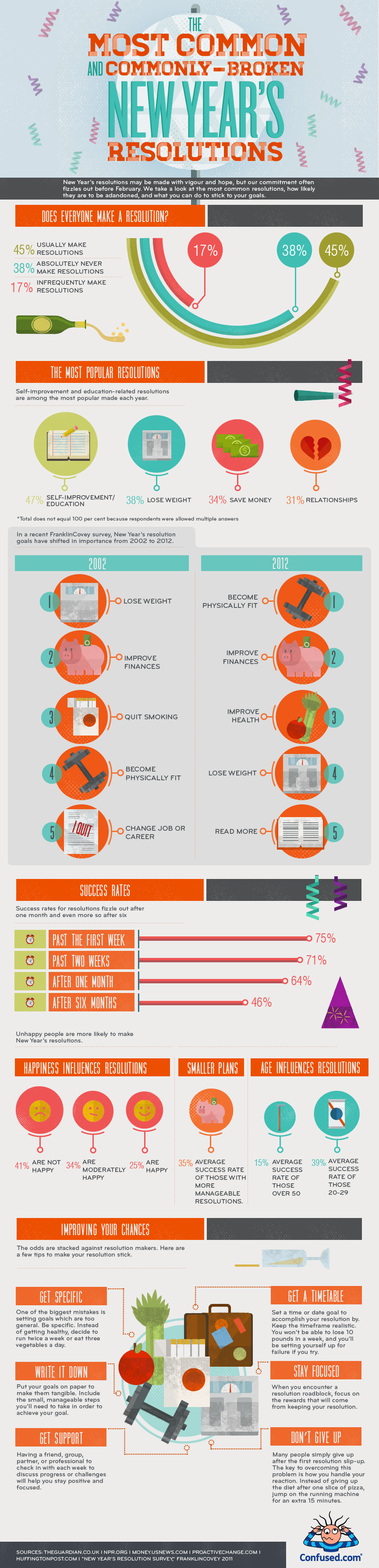

Infographic: New Year's Resolutions

BlogNew Year’s Eve has always been a time for looking back to the past, and more importantly, forward to the coming year. It’s a time to reflect on the changes we want (or need) to make and resolve to follow through on those changes.

Unfortunately, while most New Year’s resolutions are made with vigor and hope, most people don’t make it past the first month with their resolutions.

With the following infographic, we wanted to take a look at the most common New Year’s resolutions, how likely they are to be abandoned, and what you can do to stick to your goals.

For example, did you know that happiness affects your ability to keep your resolutions? Or that smaller, more manageable resolutions have a much higher chance for success?

Please take a few moments to explore the attached infographic to hopefully find a little insight and/or inspiration as you are setting your own goals for the New Year.

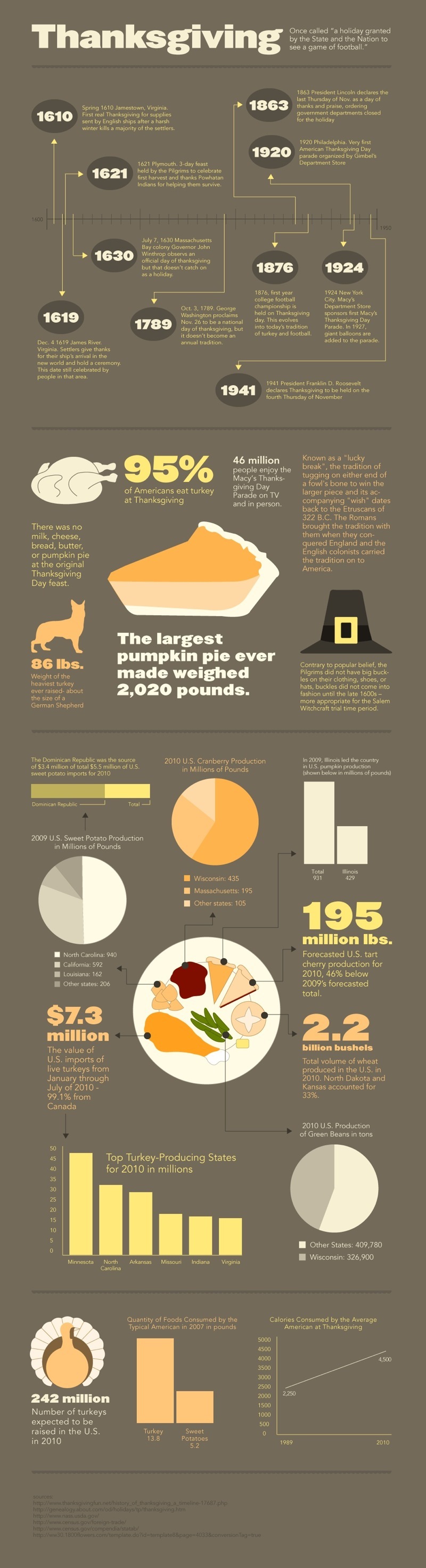

Inforgraphic: A Visual History of Thanksgiving

BlogThanksgiving is one of the biggest holidays of the year in the United States. It’s an opportunity to gather with family and friends to celebrate, give thanks, and even watch a little football.

The Thanksgiving holiday has an interesting history and several intriguing facts surrounding it. For example, did you know that the government officials tried to make Thanksgiving an official holiday in both 1630 and 1789, but that it didn’t catch on as a holiday until President Lincoln officially made it one in 1863?

Please take a look at the attached infographic that provides a great breakdown on the history of this holiday, including food consumption, parade attendance, and the real reason why we play so much football on Thanksgiving.

We hope that you have a fantastic Thanksgiving with friends and family.

Infographic: Top 5 Travel Nightmares

Arvada Insurance, Blog, Denver Metro InsuranceAs the summer comes to a close, many families use August for planned vacations. However, lost luggage, a stolen cell phone, or a misplaced wallet or purse can quickly turn your dream vacation into a nightmare.

For example, did you know that over 3,000 luggage bags are lost every MINUTE or that cell phone thefts now account for 40% of all theft in every major U.S. city?

It is with these items in mind that we have compiled an infographic of the 5 most common vacation nightmares and tips on how you and your family can avoid them.

Have a great summer!

Click on the image below to view the full size version.

Expert Service At This Denver Metro Insurance Agency

Denver Metro InsuranceAt the Holste Agency we pride ourselves on providing you with the best insurance services available at competitive prices. Our professional team provides a wide variety of services including personal insurance coverage, life insurance coverage, and commercial insurance coverage. We will also take the time to listen to you and ensure that we find that right coverage for your personal needs. Please contact us today for your free estimate. We proudly serve the Denver Metro area and look forward to working with you soon.

Receive Personal Service From This Arvada Insurance Agency

Arvada Insurance, Denver Metro InsuranceAre you looking for someone who understands your insurance needs? Someone who will provide the best service possible? The Holste Agency is dedicated to helping our customers with all of their insurance needs, and we guarantee no hassles. Our professional staff are expertly trained and treat each of our clients like family. Let us assess your needs in order to provide the best service possible. Let Arvada’s insurance experts take care of you today. Call for an appointment or free estimate.